In the labyrinthine world of cryptocurrencies, Bitcoin mining stands as both a beacon of opportunity and a maze of uncertainties. The pulsating heart of this ecosystem is the mining machine, a sophisticated device designed to validate and secure blockchain transactions. Investing in these machines, or opting for mining machine hosting services, has become a pivotal consideration for enthusiasts and professionals alike. But the burning question remains: is Bitcoin mining investment truly worth the inherent risk?

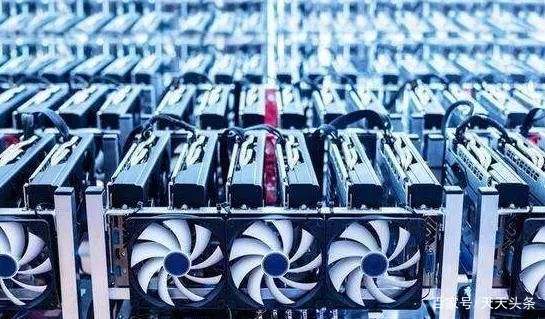

At its core, Bitcoin mining involves solving intricate cryptographic puzzles that secure the blockchain, validating transactions, and adding new blocks to the chain. This process demands specialized hardware—primarily ASIC miners—engineered for maximum computational power and energy efficiency. These mining rigs have evolved rapidly, from bulky, low-performance equipment to sleek, high-speed machines capable of hashing at terahashes per second. But acquiring this technology is only the first step; managing electricity costs, cooling solutions, and operational maintenance form an intricate dance that miners must master.

Diving deeper, one cannot overlook the burgeoning industry of mining machine hosting. This service offers a turnkey solution—allowing investors to lease mining equipment housed in facilities optimized for power efficiency and security. These mining farms, often situated in regions with low energy costs and favorable climates, provide an attractive avenue for those seeking hands-off participation in the cryptoverse. Hosting eliminates the often-daunting logistics of physical machine upkeep while granting access to cutting-edge miner fleets, thus democratizing access to mining profits.

The volatile nature of cryptocurrencies plays a significant role when assessing the risk profile of Bitcoin mining investments. Bitcoin’s price is infamous for its dramatic swings, influenced by market sentiment, regulatory landscape, and macroeconomic factors. For miners, profitability hinges on several variables—cryptocurrency prices, mining difficulty, block rewards, and operational costs. A surge in Bitcoin’s value can turn a lagging miner into a money-making machine overnight, yet a sharp decline can render even the most advanced mining rigs unprofitable.

Beyond Bitcoin, the ecosystem boasts a spectrum of altcoins like Ethereum and Dogecoin, each presenting unique mining algorithms and hardware demands. Ethereum miners, for example, historically relied on GPU-optimized rigs due to its Ethash algorithm, while Dogecoin mining, often merged with Litecoin in merged mining, employs Scrypt-based ASIC miners. Investment strategies diverge accordingly; some investors diversify their mining portfolio, allocating resources across multiple coins to hedge against single-asset volatility. This diversification adds a layer of complexity but can also dilute risk.

Ultimately, examining Bitcoin mining investment through the lens of exchanges and market accessibility unveils further considerations. The mined Bitcoins must traverse the exchange gateway to be converted into fiat or other digital assets. Exchange volatility, withdrawal fees, and security concerns add layers of friction to this journey. Consequently, an astute investor evaluates not only the technical and operational facets of mining but also the broader ecosystem that determines liquidity and exit strategies. Coupled with the emergence of decentralized exchanges and evolving financial products, the mining investment landscape is a dynamic arena demanding constant vigilance.

Moreover, the environmental footprint of mining operations is fast becoming a central narrative in investment deliberations. Energy-intensive mining farms often spark debates around sustainability, prompting miners to seek renewable energy sources and greener technologies. This pivot is not merely ethical—it’s strategic. Energy costs dominate operational expenses, so tapping into hydroelectric, solar, or wind power translates directly into better margins, reducing the risk associated with volatile electricity prices and regulatory clampdowns.

In conclusion, Bitcoin mining investment is a high-stakes gamble layered with technological innovation, market flux, and operational challenges. For investors ready to navigate this complex terrain, leveraging robust mining rigs, hosting services at well-managed mining farms, and maintaining agility across multiple cryptocurrencies and exchanges can unlock substantial rewards. Yet, with all its allure, mining demands respect for its risks and an unwavering commitment to staying ahead in a fiercely competitive field.

One response