The digital gold rush continues, and at the heart of it all lies Bitcoin (BTC), the pioneering cryptocurrency that sparked a revolution. But acquiring Bitcoin isn’t always about buying it directly from exchanges. For many, the path to accumulating BTC leads through the challenging, yet potentially lucrative, world of mining. However, the upfront cost of specialized mining hardware, known as mining rigs, can be a significant barrier to entry. This is where Bitcoin mining machine rentals step into the spotlight, offering a compelling alternative for those seeking to participate in the mining ecosystem without breaking the bank.

Bitcoin mining, in essence, is the process of verifying and adding new transaction records to Bitcoin’s public ledger, the blockchain. Miners use powerful computers, these very mining rigs, to solve complex cryptographic puzzles. The first miner to solve the puzzle gets to add the next block of transactions to the chain and is rewarded with newly minted Bitcoin. This reward is what incentivizes miners to dedicate their computational power to securing the network. The difficulty of these puzzles adjusts dynamically to maintain a consistent block generation time, ensuring a steady flow of new Bitcoin into circulation.

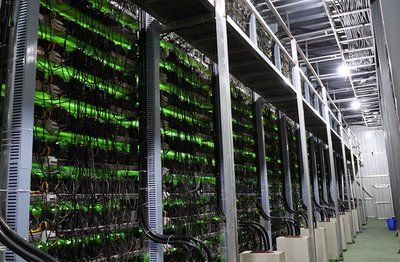

For the uninitiated, purchasing and maintaining a mining rig can be a daunting task. It requires substantial capital investment, technical expertise to set up and configure the hardware, and a suitable environment with sufficient cooling to prevent overheating. Furthermore, electricity costs can significantly impact profitability, especially in regions with high energy prices. This is where mining machine rentals offer a streamlined solution. Companies specializing in mining machine hosting provide access to their infrastructure, including the hardware, cooling systems, and technical support, allowing individuals to rent mining power without the complexities of ownership. These hosting facilities, often called “mining farms,” are optimized for efficiency and cost-effectiveness.

The economics of Bitcoin mining are driven by several factors, including the price of Bitcoin, the mining difficulty, and the efficiency of the mining hardware. More efficient mining rigs consume less electricity while producing more hashes (attempts to solve the cryptographic puzzle), resulting in higher profitability. When evaluating Bitcoin mining machine rentals, it’s crucial to consider the hash rate (measured in terahashes per second, or TH/s), the power consumption (measured in watts), and the rental price. A higher hash rate means a greater chance of solving the puzzle and earning Bitcoin, while lower power consumption translates to lower operating costs. The rental price should be carefully compared to the expected Bitcoin earnings to determine the potential return on investment.

Beyond Bitcoin, other cryptocurrencies, such as Ethereum (ETH) and Dogecoin (DOGE), also rely on mining, although the algorithms and hardware requirements may differ. While Bitcoin uses the SHA-256 algorithm and requires specialized ASIC (Application-Specific Integrated Circuit) miners, Ethereum previously used the Ethash algorithm, which was more amenable to GPU (Graphics Processing Unit) mining. With Ethereum’s transition to Proof-of-Stake (PoS), mining is no longer required to validate transactions. Dogecoin, on the other hand, uses a different algorithm and can be mined using less specialized hardware. Consequently, mining machine rental options exist for various cryptocurrencies, catering to different preferences and investment strategies.

Choosing the right Bitcoin mining machine rental can be a complex decision. Factors to consider include the reputation and reliability of the hosting provider, the availability of technical support, the security measures in place to protect the hardware and the earned Bitcoin, and the terms and conditions of the rental agreement. It’s also important to understand the potential risks involved, such as fluctuations in Bitcoin price, increases in mining difficulty, and unforeseen disruptions to the mining operation. Thorough research and due diligence are essential to minimize these risks and maximize the chances of achieving optimal returns.

Before diving into the world of Bitcoin mining machine rentals, it’s crucial to assess your risk tolerance and investment goals. Mining is not a guaranteed path to riches and involves inherent uncertainties. However, for those willing to do their homework and carefully manage their risks, Bitcoin mining machine rentals can offer a viable way to participate in the cryptocurrency revolution and potentially earn a share of the digital gold rush.

One response